How to Get Out of Credit Card Debt

Hey everyone, it’s time for something a little different. This blog post is finance-related because that’s what I’m feeling to produce right now. For those that don’t know me personally, you may be surprised to know that my first college degree was a Bachelors in Business Finance with emphasis on Financial services. I worked for many years as a financial advisor, health & life insurance agent and loan officer until the 2007-2008 World Financial Crisis effectively put me out of a job. That situation ultimately made me venture out other fields but looking back, it was clear it was a blessing in disguise because that education has stayed with me the entire time.

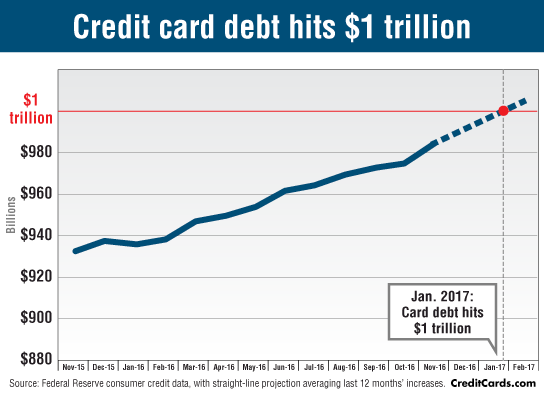

Unfortunately in the United States, we are often not taught a single thing about managing our finances during the usual K-12 education. We are taught the sciences, math, language and so on but almost nothing in regards to financial education. As a result, everyone seems to get into debt, even if they have good income! So now I will be sharing some tricks that may help you better manage your debt.

First, stop feeling shame or avoiding the topic!

Whenever someone is in credit card debt, they might feel shame or guilt about their finances. It’s actually pretty common to ignore or avoid the topic entirely because it makes them depressed. Well, you need to put yourself in a position of power and get in control and take life by the reigns! Next time the bills come don’t just put them by the wayside. Look at them. Face them. Come to terms with them.

Next, find out what the balance is for every credit card and what the APR interest rate is for each of them.

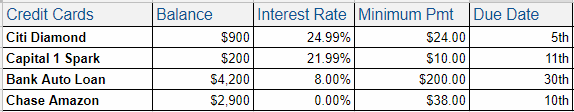

I want you to make a list of every credit card and loan that you have a balance on. Find out how much is owed and find out what the interest rate is for each of them. Either call them or login on the website and get that information.

Put that info in this spreadsheet I have created for this purpose

- I created a Google Sheet to help you organize your debt and sort out which ones you should prioritize paying off.

- Save a copy for your own self by going to File -> Make a Copy…

- With your own copy saved in Google Sheets, you could edit it however way you want. Add rows, delete rows, do whatever you need to customize it.

- You’re basically going to list all the credit cards and loans you have. Put the name, balance and interest rate for each. And then sort it by the interest rate (column C).

- Now, it will be extremely clear which one has the most interest rate and what the balances total up to.

Strategy Time

- Prioritize making the biggest payment you can to the card with the highest interest rate. Never make only the minimum payment for the ones with the highest interest rate. You’ll never get ahead. They purposely make the minimum payment low and the interest rate high so that you can’t pay it off for decades.

- Collect 0% interest-free offers that come by mail and apply for the best ones. They start sending these out before the holidays quite often. Figure out which one is offering 0% for the longest term and for the lowest fee. They usually charge 3% balance transfer fee. If they charge 5%, that’s a bit too high. (But, you might be able to call them and ask them to lower it to 3% if the deal is good.)

For example: If you have $6000 in credit card debt with an average 22% interest rate… and you apply to one of these 0% intro offers and get approved for $6000, you will have a 3% fee tacked onto it. So 3% of 6000 would be $180 so it would be $6180 that you’ll owe. This is far better than paying $6000 with 22% interest! This way, you could pay it off without feeling like you can never catch up!

ProTip: If you have a late fee, even if it was months ago… always, always, ALWAYS call them and ask them to reverse the fee.

You won’t believe how easy it is to do this sometimes… You call the credit card company and the automated system will ask, “What are you calling about?” and you say “Reverse a late fee.” Sometimes the system will automatically do it for you without even needing to speak to a human being. This has worked for me at least a couple times in the past couple years! And if you need to speak to a person and they ask you why was your fee late, don’t go into detail.. .just say something very short and reasonable: I was traveling and I had lost my wallet. It never hurts to ask. The worst that could happen is they say no. A penny saved is more than a penny earned. (Oh and they won’t reverse it if you haven’t made the payment for the current month, so do that first.)

Call them and tell them you want the interest rate to be lower

Another thing you could do is to call them and ask them to lower the interest rate because you have a card that’s lower than that. You never know whether they will actually be able to do that until you ask. This one is less likely to work if your credit isn’t good, but again, it never hurts to ask.

In conclusion…

With a set plan, you will feel empowered and take control of your finances, rather than letting them rule you! It’s not easy getting out of debt, but you have to start somewhere! And last but not least, close these credit card accounts. When you cut yourself off from them, you won’t have the ability to rack up the debt. Failing to plan = planning to fail. So take the time to plan and create a strategy! “A penny saved is a penny earned” is one of the most important things to keep in mind, otherwise your hard earned money is going down the drain to these sheisty companies.